The importance of being PRUDENT – How small businesses can become resilient in times of crisis.

The importance of being PRUDENT – How small businesses can become resilient in times of crisis.

First appeared on Cleantech Geek | link

Be Bold. Make the Change. Have a meaningful Impact.

Almost a decade ago I wrote an article, titled “How to Survive an economic Recession for Dummies”, when the financial crisis had caught-up with me back in 2009-2010.

At the time I went through a catastrophic failure, as all the ventures I had collapsed, I had to make all my employees redundant and see everything I had worked hard to build over 5 years, collapsing within a period of six months.

So, I started writing more as a self-healing process reflecting my personal lessons from my own failures, rather than anything else. It was then when I took the decision to become an expat and start over, firstly in the Netherlands (didn’t work out…) and then in the UK.

Never in my worst nightmares would I have expected to live in such a short period of time a second (some say deeper) financial recession, this time due to a global pandemic.

Even though, on a personal level I was not as affected as the first time, I had the opportunity to identify specific patterns that especially small businesses had to face during both recessions.

Over the past 9 months, either through the university or our hybrid accelerator, I spoke with many different founders, and business owners on how the COVID-19 pandemic affected their business and how they are handling the current financial crash.

Through personal experiences and multiple discussions and stories I collected, I came up with seven (7) points on how businesses can become more resilient during hard times.

So, what you need to do, is to be P.R.U.D.E.N.T.

Plan for Reconstruction and Build Assets

As you build up your business there are core building blocks that you will need to develop. These blocks are your Assets. New business norms have forced us to reconsider the way we conduct business and re-engineer many of the processes we had within our businesses. In order to rebuild, you need to first deconstruct and go back to the basics. As you are building up think about your Market, your Products / Services, your Brand & IP, your internal Systems and your Strategic Assets.

As a business you need to reconnect with your values and your whys, you need to rediscover the needs and wants of your customers, understand theirs pains and provide true value-added solutions to them.

Naturally, crisis puts us into survival mode, however it is also a chance to change our state of mind, reevaluate, take a step back and rebuild a better business.

There is a wonderful book by Daniel Priestly “24 Assets” which provides some excellent insights on these fundamental business building blocks that you need to develop.

Redesign Products / Services and your Marketing Approach.

The pandemic accelerated the adoption of e-commerce and digitalization of business transactions. Therefore, you cannot be ignorant or blind to the fact that you will need to redesign your core products or the delivery of your products and services to fit the new transactional model. Remember that going online or just building a new online service channel will not solve your problem. Going online means that you are now competing in a global market with global competitors. So be careful how you utilize your cash reserves or your profits as you might invest time, money and valuable resources to build electronic tools, while at the same time shifting your attention form more important issues like your products and your clients.

Take the time, reach out to your clients, and try to redesign the products and services you offer with them. Make them part of the solution. Try to maintain your most profitable products and focus on redesigning or even killing less profitable ones.

Remember that when you redesign your products and services you will need to take into consideration the principles of Ethical and Conscious Branding and Collaborative Sales Methods. Consumer behavior has shifted, and you need to shift with it.

One of the best ways to communicate your “new” products and services is to concentrate on content generation (creation of your digital assets). There are infinite free resources and collaborative platforms which will allow you to effectively communicate your message. Especially digital assets remain there and act as multipliers.

When you design your products also think about the different types of products that you may need to create in combination with your marketing campaign.

As an example, can you create products / services that can act as hooks? Can you design products of services with very low cost that will allow your clients to have a first experience and interaction with you?

Don’t get me wrong I would never recommend creating loss leaders, but how you design and define your product / service line is up to you. For example, freebies and “loss leaders” should perhaps exist under your marketing and not within your core product mix. Label, budget and measure prudently.

Finally, when you productize, think of your strategy to market your products.. It is much easier to upsell or achieve a new sale with existing clients, instead of constantly generating new sales. Always think about product families which can be sold after your initial sale and interaction with your clients. Repeated sales with low marketing effort and cost are where you make your profit.

Unify the Team.

Team is everything in today’s business world. Usually, in times of crisis team members become easy victims in our crusade to reduce cost. Business owners go into survival mode, take everything upon themselves, isolate, feel stressed and take it out on their employees. This is a recipe for failure and not crisis management.

Allow me to make a statement. Your employees are not working for YOU. You work for them. You are responsible to provide them with whatever they need, give them the chance to thrive and use empathy and honesty when you deal with them.

As you can imagine your team is essential to pull your business out of the hole. In times of crisis your job as the business owner / manager is to unify your team around your business. Believe in people, communicate with them and make them part of the solution. It is better for all to make sacrifices instead of some to lose everything. Clearly communicate the issues you have and explain in plain terms what needs to be achieved. Ask their opinion, give them the space to express themselves without fear. Give them timelines of how long you expect things to be “in the red” and what sacrifices you expect everyone to make starting with yourself. I am certain, you will be surprised with the collaborative spirit and empathy that your team will express and furthermore with the gems that they will come-up for improvements across your whole organization.

This is the time when you need to demonstrate leadership and be in the front, instead of hiding in your office and blaming everyone else for what went wrong.

Simon Sinek’s “Leaders Eat Last” is a very good read on the importance of Leadership.

Diversify your business, Persevere or Pivot.

When faced with such devastating situations every business, every entrepreneur has to answer the question of Business Diversification. Everything comes down to a seemingly simple question. Is your business making enough progress under the circumstances to continue ahead and persevere or do you need to pivot.

Business diversification can take two forms. You completely change strategic direction, in other words you Pivot or you expand in new markets by re-engineering and adopting your offering without necessarily changing your strategic direction, in other words your apply a correction (Iteration) and expand persevering down the same route.

The compass for such a decision is the market itself, your clients. Companies that fail to bring themselves to act towards a specific direction on the basis of feedback from the marketplace are in danger of becoming zombie-companies stuck in a state of neither growth nor oblivion. This state can suck dry a company of its resources and completely destroy dedication and commitment from its team members.

Whether you persevere or pivot you should not be afraid to try, test and fail. We learn from our failures. However, your decision should be based on true, well calculated data and not just a feeling.

In his book “The Lean Startup” Eric Ries describes that a business has a specific number of pivots left. This is the company’s runway and represents the amount of time remaining until a company must either make it and achieve lift-off or fail. This is calculated by dividing the available cash by the monthly burn rate.

Now what happens if the runaway is running out. In an environment of crisis, you cannot usually raise additional capital, except from situations where you have government support, therefore you are forced to cut costs.

This is critical as diversification is fundamentally a business strategy and direction decision, a strategic hypothesis. During a crisis you need to make decisions fast. The only other way to extent your runway and make a better use of the time given to you is to test more strategies faster, in other words, validate what works and what doesn’t.

Doing so takes courage and requires a sound measuring methodology and validated learning. Otherwise, you are just blowing time and resources in the wind.

Enhance Cashflow and Operational Savings

Cashflow is king! I am sure you have heard this expression. Companies with a healthy cashflow and cash reserves can access debt financing much easier than others. You can get better deals on your procurement (remember especially in retail, you make your money on procurement) and also attract better talent with higher salary and bonus incentives. In crisis though you need to make your cash go further. The first move is to have a clear understanding of the burn rate of your cashflow. In other words, you need to KNOW YOUR NUMBERS. If you haven’t budgeted before now is a good time to start doing it in detail. If you can’t, get help. Knowing your numbers will allow you to close holes that burn cash reserves. It will also allow you to understand income and outgoing payments. This is very important as rearranging and rescheduling payments can have an immediate positive impact on your cashflow.

Concentrate on high profit items. Rethink and adopt your marketing budget. Never kill marketing. This is a rookie mistake that most businesses do. In crisis you need to sell. Effective marketing (even through free resources) acts as your brand and sales megaphone. Speak with your clients to see whether they can give you further visibility on upcoming orders. Incentivize them with a discount strategy, which will not kill your profits. It is a mistake to adopt a pricing policy which will just cover costs and allow you to barely stay alive. Engage your suppliers to see how you can optimize payments and get further discounts. Same applies to property that you might rent. One of the biggest inelastic expenses is rent. So, speak with your landlord and negotiate.

Obviously, the days you could spoon-feed your business are over. Even in a normal situation a prudent approach would be to gradually built-up a cash reserve, which would allow you to cover 3-6 months of operational costs & expenses. Experience has proven that these cash reserves now need to be able to cover up to 12 months of operations. If you don’t have the reserves already things will be more difficult, but even if it sounds impossible you should start saving, while you can.

Network. Identify the partners and people who can help you.

Over the last decades the way that business is conducted has changed dramatically. We started with process focused businesses, to reach now a more interactive collaborative model. Technology became such a structural enabler, with businesses forced to adopt new solutions across the board. The way we source and procure, how we make and produce and how we sell is constantly changing. The pandemic is a true testament on how quickly things can change and the rate businesses have to adopt.

Your Network and Partners will be your enablers to effectively productize and diversify if necessary. Your network acts as your brand and sales ambassador, they are there to support and make introductions, both at the front and back-end of your business.

Once you have a clear understanding of needs and wants of your clients and a line of products / services that fulfill those needs, it’s time to reach out to your existing business partners; your suppliers, your wholesales, your logistics providers, even your accountant and your graphic designer can help you in this time of need.

If you do not have a CRM system then, dust-off that old telephone book with your contacts. Create a circular doodle with consecutive cycle, put family and friends in the inner contact circle and continue with business contact on the outer ones based on the importance and frequency of contact. Write down a small action plan / tracker of what you want from each individual contact. Also be prepared to tell them what you are willing to give them or trade. Clearly explain your situation, the reason you are contacting them and how you could help each other. Remember it’s about creating a collaborative environment, it’s about “give and take” without ending up giving a whole pack of IoU cards.

Your network can help you from simple things like joining you on a social media group, sharing your posts and articles or helping promote a new product and service through their respective network (this is one of the key reasons that creating digital content is extremely important, it’s easy and inexpensive for people to like and share).

Existing business partners are even more important. Your suppliers will have to help you if they want to retain you as a healthy client. Be sincere and negotiate with them more favourable terms at least for the time until the crisis is over.

Better payments terms, extended credit, lower supply chain costs, discounts on production, better training for your team and market intelligence are some good examples on how they can help.

Transform & Innovate in practice.

Business transformation and innovation are not just buzz words made for big corporates with deep pockets, they apply as much to small businesses and startups.

Innovation in practical terms is what you do to improve the processes and procedures within your own company. Maybe the implementation of a mature well known and widely used technology is not innovative per se, but it is an innovation process for your business. The way we now communicate and the wider adaptation of communication and collaboration platforms like Zoom, Google Meets and Microsoft Teams is considered an innovation for companies that their employees needed up until now to be physically present in a room to communicate. Your new e-shop through Shopify, your new packing machine, your new tools are all practical innovation examples for your company.

You need to be mindful that as a small business you should aim to transform your business and innovate with two goals in mind, Sales Boost and Cost Reduction. Sales Boost is about the product/ service you deliver to your clients in order to better serve the needs of your existing clients (i.e. providing better products / services, at more competitive prices and easier accessible) and how you open up new market segments or territories. Cost Reduction is about transforming and innovating internally. It’s about optimizing production, minimizing time and cost to produce a unit of your product or to deliver a service. Think, what can you do to improve efficiency, what new assets can you create, how can you do more with less with the assistance of technology and people? A good example on this is the fact that many companies are willing to innovate by bringing inhouse data capture systems and specialized analysts as digitilisation comes more on the centre stage and data becomes the new global currency.

Lastly, I would like to add another dimension to the transformation and Innovation. Be certain that these two terms are not just applied to the actual business. They are as relevant for you as a person / business owner and for your team. Caught in the everyday struggle we usually forget about our self-development as professionals and as people. So, when thinking to transform and innovate give the time and the resources to you and your team to learn, evolve and change the way you perceive things. Transformation and Innovation come firstly from a creative state of mind. It starts with you and your people.

This time around the crisis has different characteristics. The pandemic completely changed consumer behaviour and forced the shutdown of business (especially for business in the high street on HORECA and retail). This was a massive blow to many business owners and thousands of employees. We are just starting to scratch the surface of the upcoming financial crisis and we don’t know when we will rebound. This article does not aspire to be a definitive guide on “How To”, but rather to give you my perspective on small business crisis management, from experiences that I lived and lessons I learned through my failures and by examining failures of others.

Concluding this article, the way I see it, each and every one of us has two choices:

- Accept your fate, roll down and blame everyone else for the situation or

- Pick yourself up, change your mindset and act. The choice always remains yours.

See more on Cleantech Geek's YouTube Channel

Scotty the Scientist - Venture Tinkers Avatars 1/5

Introducing the Venture Tinkers Avatars

Through endless discussions and interactions with different players of the startup ecosystem, we have identified the main "characters" you will most likely meet during your entrepreneurial journey.

On this series of blog posts, we are diving deeper into each avatar’s motivations and concerns while outlining how the Venture Tinkers team can help them overcome their challenges.

This week we are excited to introduce you to Scotty the Scientist. Scotty made a scientific breakthrough and wants to continue his research and commercially exploit the findings.

One of the major problems scientists like Scotty face is shaping their research into a marketable product which will become the foundation of a profitable business. We have identified some of the root causes:

- Lack of business acumen and absence of a long-term strategic plan.

- Inability to articulate the company’s vision, target geographies and go-to market strategy.

- Absence of a strong team to support operations, management, sales, R&D etc.

- Unclear problem definition, customer segmentation and product offering.

- Lack of clear roadmap, milestones and goals for the foreseeable future.

Other problems also include:

- Capital intensity to develop and launch a Minimum Viable Product (MVP), which makes it hard to raise investment. It’s like a vicious cycle. You cannot do the one without having the other.

- Sometimes, scientists tend to be fixated on the technology they have developed which provides little room for pivoting and adjusting to the conditions of the external environment.

- Lastly, research conducted in universities might by subject to special conditions. We have seen university spin-offs facing problems with IP and technology rights, which are sometimes owned by the academic institution instead of the researcher.

When Venture Tinkers come to the rescue

Our first task at Venture Tinkers is to provide you with insights and help for a smoother transition to the startup ecosystem. The cultural differences between academia and startups are evident. Therefore, the transition might seem daunting at first, and will surely not happen overnight but there is a specific skillset required to succeed in the world of venture-backed early stage companies.

We will help you shape your future business in a way that is easily comprehendible by a general audience. This includes creating a storyline that inspires, without getting into technical language or in-depth scientific findings. Communication is very important, since you will need to convince non-technical people (clients, investors, future employees etc) that your product is worth a shot. And this is not a one-off endeavour, similar to research grands, but rather something that needs on-going effort and fine-tuning. Although it does get easier and the Venture Tinkers team will be by your side to help shape your ideas into a product worth buying or investing into.

After shaping the initial communication material and some possible ways to market the product, it is crucial to get validation from the actual market. Together we will create a go to market strategy and customer engagement roadmap to gather and analyse feedback in order to incorporate the findings and adjust the product or service accordingly.

Once the company has developed a tried and tested methodology to enter the market we will guide you to create a Minimum Viable Product or a working prototype (depending on the situation) with minimum cost. This step is very crucial to start receiving order requests and show traction to future investors. Please note that you don't have to build the actual product just yet, and these pre-orders will help fuel your company to get to the next level, while having customers already commited to buy once the product is ready to hit the market. Following this strategy we will raise awareness for your brand and render the early adopters part of your mission to change the world. A great strategy to attract potential early adopters is by launching a Crowdfunding Campaign. Although this is not applicable to any product or service, if it does, it can have great results.

The Dos for Scientists like Scotty

Always be transparent with your research and the results of your trials. You definitely don’t want to end up like the infamous Theranos. https://www.businessinsider.com/theranos-founder-ceo-elizabeth-holmes-life-story-bio-2018-4

Ethical behaviour: Bringing years of research to the market is substantially increasing the scientist’s responsibilities. Never misrepresent or falsify data to draw a more favourable image for your business.

Authority: Make sure to showcase your previous work (such as academic papers related to your research) and any awards you have received. Create easily digestible content (such as a blog) and participate in industry events as a panelist or moderator. This will help your customers and investors realise your value and will open up the route for new connections.

As a final note, the journey from invisible to investable is not an easy one to embark on. But it can definitely be rewarding and by having the Venture Tinkers team by your side, it will surely be an enjoyable ride.

Inside Cleantech – S2E2 – Insights of a Green Entech Technologist – Interview with Andrew Eisenberg

Inside Cleantech – S2E2 – Insights of a Green Entech Technologist – Interview with Andrew Eisenberg

First appeared on Cleantech Geek | link

Be Bold. Make the Change. Have a meaningful Impact.

At this series we discuss with experts, senior executives and influencers from the Cleantech and Renewable Energy Industry as well as from the Entrepreneurship and Investment World. Find out about their opinions on the future of Green Entech and Cleantech, get their insights on opportunities & risks, discover the secrets of successful businesses & ventures, learn from their successes and failures.

On this interview, I am discussing with Mr Andrew Eisenberg, CEO at Green IT Energy Applications. Andrew, is giving us his opinion on critical subjects as a technology provider for the last 20 years in the USA. Green IT, has been a pionner in developing technologies specifically designed for the Renewable Energy Industry. Green IT provides end-to-end data capture and management systems on Solar, Wind, Storage and Hydro across North America. Filmed with Zoom in an isolation environment due to COVID-19 pandemic, Andrew and I, are discussing about his journey and the current state of the solar PV industry in the US, the importance of Cybersecurity and critical fact data acquisition, validation and analysis for the Renewable Energy Industry. Get Andrews personal view on how data are critical for the decision making in an unsubsidised environment and how he sees the new normal for him, his team and the wider industry in the aftermath of COVID-19.

Please watch the video and leave your comments below! Don’t forget to subscribe and like!

The Cleantech Geek YouTube channel has been created out of the need to understand the drivers behind the Energy Transition and the necessity to move towards a sustainable economy. Entrepreneurs, innovation and startups will be at the forefront being the early adopters, the pioneers, the disruptors... Join us on this Journey!

See more videos on the YouTube Channel

Spread the message. Be Part of the Clean Revolution!

An Angel's Insights, Investing in a crisis | Interview with Angelica Morrone

https://www.youtube.com/watch?v=SL0dJC3INHw&feature=emb_title

An Angel's Insights, Investing in a crisis | Interview with Angelica Morrone

First appeared on Cleantech Geek | link

Be Bold. Make the Change. Have a meaningful Impact.

Cleantech Geek – Inside Cleantech Series – Series 2 : Episode 1 – At this series we discuss with experts, senior executives and influencers from the Cleantech and Renewable Energy Industry as well as from the Entrepreneurship and Investment World. Find out about their opinions on the future of Green Entech and Cleantech, get their insights on opportunities & risks, discover the secrets of successful businesses & ventures, learn from their successes and failures.

On this interview, Ypatios Moysiadis discusses with Angelica Morrone, Fund Manager and Angel Investor in Impactful Ethical Ventures. Angelica, is a co-founder of an asset management company which to date has invested and managed a coumpounded USD 2 billion and over the years she has built a private real estate portfolio worth USD 90 million. She is an active Angel Investor for the last 20 years.

Angelica offers a unique insight into the mind of an Angel investor. She gives us her insights on the current unprecedented situation, how the investors are reacting, which industries are considered safe bets for the future and how entrepreneurs and business should react in the situation. Filmed with Zoom in an isolation environment due to COVID-19 pandemic, Angelica and Ypatios, are discussing about her journey and her decision to invest in impactful ventures through various platforms like Venture Tinkers, how can startups raise money in a crisis and what are the lessons learned from profound time in human history.

Please watch the video and leave your comments below! Don’t forget to subscribe and like!

The Cleantech Geek YouTube channel has been created out of the need to understand the drivers behind the Energy Transition and the necessity to move towards a sustainable economy. Entrepreneurs, innovation and startups will be at the forefront being the early adopters, the pioneers, the disruptors... Join us on this Journey!

See more videos on the YouTube Channel

Spread the message. Be Part of the Clean Revolution!

The importance of being ANGEL(ed)

The importance of being ANGEL(ed)

Let’s start from the definition: an angel investor is someone who invests in a new or small business venture, providing capital for start-up or expansion. Angel investors are typically individuals who have a good tolerance for risk, cash available and are looking for a higher rate of return than traditional investments and for companies aligned with tier values or interests. An angel investor return objective is usually in excess of 25 percent.

Angel investment, its most seen occurrence, takes the form of equity financing, whereby the investor’s money is exchanged for an equity position in the company. The valuation used to determine the equity share is a most important subject worthy of its own space.

Angel investors fill in the gap between the small-scale financing provided by family and friends and venture capitalists. Angel Investors can be found everywhere, however they do not advertise and flaunt, which makes it a bit tricky to locate the investor that is interested in your sector and that whose personality is right for you.

Pros and Cons

Getting funded with angel money is a bit like entering into a marriage. Like any partnerships, it has clear advantages and a few disadvantages.

The big advantage is that funding from an angel investor is much more stable than debt. Angel Investors do not expect the investment to be paid back in the event of business failure. Even more importantly, most angel investors understand business and take a long-term approach and view. Furthermore, every time an angel investor decides to cut the proverbial check, they are surely investing but also looking to have a positive impact on the venture they are financing. Most angels invest in sectors that they know or that they feel a kinship with. With the funding, they also bring to the table their competence, connections and experience.

One disadvantage may be that most angel investors will want to have a say in the strategic direction of the company and in the steps that the management team intends to take to reach their goals. This may feel like a constraint only if the fit with the investor was not right from the beginning, or if the communications from the entrepreneur is not transparent.

Moreover, it is important to know and to consider what an angel investor usually looks for and whether your venture is in the position to fill those needs.

Criteria of Investibility:

- Return – every investor looks for a solid return, they know that the risk is high, hence it’s worth taking only if the potential return is higher than what can be achieved with traditional investment channels.

- Reason – every person has different reasons to invest. However, they can be divided in 3 categories: economic, hedonistic and altruistic. The hedonistic type gets excited in being part of the creation of something new, while the altruistic looks for an investment opportunity aligned with her/his values and that has a positive impact. Ensure that you know who you are taking to and pitch accordingly!

- Team – any early stage investor attributes as much or more value to the management team as to the product or service. The management team has to be dedicated, competent, trustworthy and knowledgeable. The right mindset will be looked for.

- Business Plan – Even at an early stage, an investor will want to see a well devised business plan, it is a way of showing your vision. A business plan is both the roadmap to the vision and the binoculars to see the final outcome.

- Investment readiness – while there are different modes of investment, you must ensure that you have thought about your ask and your give, that you have a basic investment memorandum ready before you speak with an investor.

- Involvement – as I mentioned before, most angel investors are looking for an opportunity to contribute their skills and connections. Be prepared to offer something that allows for this to happen.

- Exit – Even if they take a long term view, investors will want to see certain timeframes and an exit strategy.

In conclusion, like any relationship, establishing a relationship with an angel investor requires work and involvement in order to be profitable and fulfilling.

In my book, Invisible to Investible, What your investors want, I go into more details about the topic.

By Angelica Morrone, Partner at Venture Tinkers

6 Major Points to remember when planning for Mobile Device Management in the working environment

Smartphones and tablets have changed the way we operate, the way we work and the way we communicate, both in the work environment and in our everyday lives.

The strategies towards new technological applications that providers and hardware companies are enforcing as well as the bohemian bourgeois lifestyle that the Western World is adopting (see Steve Jobs and Elon Musk) leads to deep penetration of the market and adoption of mobile devices from consumers.

This change in behavior alters the ways that information is transmitted, stored and managed. So much so that companies are forced to develop a corporate policy towards the use of Mobiles and tablets in the workplace.

The guidelines below are the basic lines of policy formation in which any corporation should address this issue.

- A Plan: Change is upon us – we need to embrace our changing environment and plan ahead to how we can adopt corporate technological tools and procedure to maximise on and create new opportunities through this changing phase. In this instance, a flexible and adaptable plan is absolutely paramount before the implementation of any such process or system.

- A Platform Choice – In the current market there is an overwhelming choice of different devices with different operating systems and different capabilities (see Apple OS, Google Android, Microsoft Mobile Windows, Blackberry, etc). Each operating system is suited to different uses and to the different attitudes of user, so it is only natural that employees make their personal choice of the device and platform they wish to use. Adapting a cross-platform policy for any data or applications you are going to introduce within the working environment means that your employees will be able to work more efficiently and effectively with an operating system that suits them personally. However; in order to implement this change, employers must first make sure that devices are compatible with the systems they use as a business.

- A Secure System – If your business deals with sensitive data then you simply must be aware of the risks that come with online devices. Security is a top concern when dealing with many devices and operating systems. Each one of them or each combination has its own security problems and threats. Adopt data security policies, use data encryption, install backup systems, use user authentication and match devices to individuals. Make your employees part of the solution and train them in order to understand the risk and the threats associated with sensitive data.

- An Opportunity – People, processes and deliverables: these points represent an opportunity. Businesses must identify the opportunities with which they are presented regarding mobile devices. How can mobility positively help the communication between team members of your company? How can this new technology empower the creation of virtual teams and monitoring of production and projects?; Can your business processes positively change by adopting mobility?; Can you save time and improve coordination?; What about your deliverables – How can mobility help you track production and quality as well as get live feedback from your stakeholders, your employees, your suppliers and your customers. There are legitimate opportunities in technology that will present you with solutions to these problems.

- A Simplified Strategy – Ask your employees how the adaptation of mobile devices can be simplified and help them in their everyday work and communication. Actively involve them in order to reduce the resistance to change and avoid adding initial complexity to their working environment. Facilitate different technologies and remember that not everyone is a “techie” Help them keep up with the technology that you are adopting, train them properly, give them the time to swallow changes and provide them with the means to update their devices and applications regularly and when applicable.

- A Mobile Device Management System. What to choose? – There are many options when it comes to Mobile Device Management systems; Choose your supplier and your provider very carefully. There are no magic solutions here. If you have identified the need to implement a mobile device management system but you are not proficient with the technology and the different solutions outsource this task to a specialist consultant or hire accordingly. Keep in mind that solutions that worked for others businesses will not necessarily to work for you. I would argue that the biggest gamble in adopting software like this is not the platform you choose, but the way in which you position it with your employees to ensure uptake. Choose an open source flexible solution that can manage cross platform application regardless of the devices used by your people and of their physical location.

Culture, ethics and perceptions are changing faster than we can adapt. I remember meeting the CEO of a listed company in London, over a casual coffee after a simple phone call both wearing jeans and t-shirts. Ten years ago you would need to pass through 3 secretaries and arrange a meeting 3 months in advance to see such an individual at his gentlemen’s only club wearing your Savile Row suit.

The same principle of cultural change applies to mobile device management. In an era of constant technological evolution, it’s simply Do Adapt or Die.

By Ypatios Moysiadis, first appeared on http://cleantechgeek.com/2017/03/mobile-device-management-embracing-change-in-the-working-environment/

8 Reasons why Small businesses and Startups fail

8 Reasons why Small businesses and Startups fail

By Ypatios Moysiadis, first appeared on Cleantechgeek.com

“Failure is the opportunity to more intelligently begin again…”

Henry Ford

Today I’m going to explain to you what I see to be the essence of failure management and this is how failure should be managed by entrepreneurs and businesses.

Learn from your mistakes and make them part of your business experience. Try not to repeat them and always try to accumulate knowledge from more experienced professionals or experts. The attitude “I know best for my business” in most cases simply, doesn’t work.

An analyst can classify the reasons for a startup and SME failure in multiple categories. Here I am going to try and present the most common and logical.

- How big are you?– The size of each given organization is closely related to the failure rate. In general the bigger the better. This is due to many reasons. For example the number of employees is an indicator of a healthy company with steady growth rate, competitive and better positioned in the market, with larger market share. There is also the “Critical Mass” factor. Some companies are just too big to fail. Just see how the banking sector was bail out during the last crisis in 2008

- How long have you been around?– The age of the business is again a critical survival factor. The important dates to watch out are the first year, the third year and the fifth year. Within this time period, if you survive, you probably gone through all the “childish diseases” that start-ups and small SMEs face. Sales problems, identity problem, market positioning problems, staffing problems and funding problems. Normally after the first five years you are ready to capitalize on your customers, your network and your business. It goes without saying that after 5 years you are no longer a start up.

- Which is your main business sector?– An old story when it comes to business failures. The same conditions and the same rules do not apply in every business sector. Take for example the 2008 financial crisis. The first sectors to go were service based sectors (like banking, insurances, advertisement, media) in addition to real estate and automotive sectors i.e. sectors that are consider growth driven. In comparison businesses operating within Energy, Food and Health sectors managed to limit their losses. This is due to the fact that in any crisis survival instincts are kicking in, resulting in spending just for the essentials. Good examples on both sides of the fence are the Royal Bank of Scotland which was saved by the UK government as part of a massive £37 billion bailout deal (as of August 2015, UKFI has a 73% stake in the bank) and Costa Coffee UK’s leading coffee shop chain, which in April 2013 reported an annual revenue growth of 24% with 44 quarters of consecutive revenue growth!

- Where are you geographically based?– Another critical factor for business failures is the actual place of operations. Countries play a vital role on the development, growth or failures of businesses. Take as example the ongoing economic crisis in the so called P.I.G.S. (Portugal, Ireland, Greece & Spain) countries. Companies in those countries are more vulnerable to failure despite their sector, their size and their age. The reason is that the affected economic environment is changing the consumer behavior trends, investor’s confidence and disrupts financial transactions. For example in 2015 Microsoft cancelled a major new investment in Greece despite their initial pledge to support the technology sector of the country. Coca Cola Hellenic Bottling company Greece’s biggest quoted company left the country in favour of London and Switzerland. Many companies regardless of their size and industry followed by migrating to neighboring Bulgaria and other EU countries or stopped their operations.

- What are the economic conditions in which you operate?– Closely related to the previous point. You need to be aware of the macro and micro economic environment in which you operate. Nothing is for granted. Be aware how things around you, can affect your business and insure your survival. Taking examples of the recent events, if you are in the green business you are probably going to see a potential growth due to the recent decisions at COP21, the shift of consumer behavior to more sustainable products and services and the recent environmental and nuclear catastrophes. If you are heavily depended on the US market a potential second financial crisis (debt management problems) will affect your customers and can put you out of business, if your suppliers are from Middle East you will probably face supply problems due to the ongoing conflicts, etc.

- Who is the boss?– This has to do with the capabilities of the people that manage the business. Especially in start-ups and SMEs the abilities and the personal attributes are of essence. The previous experience, the track record, the education and immediate personal environment (family and friends) can play a catalytic role on the survival or failure of a business.

- Show me your colleagues!– Essentially show potential investors the team, the people who you work with. The team spirit and the team chemistry are important in small sized businesses where multitasking is an everyday occurrences, narrow roles do not exist and the importance of every individual for the team’s success is critical, “…the chain is as strong as its weakest link”

- What do you sell?– How mature or innovative is your product or service? What you sell, when do you sell it and what is the perception of the market for your product/service can make you or break you! Examine innovative companies with products ahead of their time. Example, the electric cars – the demand is minimal due to price, the non-existing support networks and the infancy level of the technology. So the product is not as yet ready to be mass produced and accepted by the market, despite the noble efforts of TESLA and a few others. However as supportive networks and rapid charging points become available and the technology progresses your product will become more relevant to the market needs.

So always be prepared to make corrections and adjustments to your business model. Try to build up a diversified customer base and try to exploit the biggest advantages you have as an SME; flexibility and the ability to adapt to the market needs.

Always plan to face the worst case scenario. Remember No Plan or Policy can be formulated for any given startup or SME without a fundamental understanding of the importance of business failure.

And to sum up as I started – “… The single reason companies fail is they over invest in what is as opposed to what might be…” quote by Gary Hamel – Business Thinker

Ypatios Moysiadis

The Trap of Pitching for Investment – Why you should Start selling & Stop pitching

The Trap of Pitching for Investment – Why you should Start selling & Stop pitching

This post first appeared on Cleantech Geek: http://cleantechgeek.com/2019/11/the-trap-of-pitching-for-investment-why-you-should-start-selling-stop-pitching/

This presentation is conducted by our partner, Ypatios Moysiadis and uploaded on his personal blog. Make sure to check out the blog for interviews, opinions and insights on sustainability and entrepreneurship! Combining articles, video and podcasts he intents to provide the stage for creative thinking and constructive discussions. http://cleantechgeek.com/

At this video I am presenting about a common mistake that many early stage startups do. We see more early stage startups concentrating on pitching for investment, running from pitching event to pitching event and completely neglecting sales, which is the only thing that will sustain them and allow them to grow. Furthermore market validation through sales is guaranteed to bring in investors. I am also giving away practical examples and tips for sucessful sales. So my advice, before you start looking to raise investment capital, validate your idea through the market and start selling! Big thank you to Daniel Priestly, Andrew Priestly and the Dent Global team (https://www.dent.global) for their support and executive training over the past 12 months.

Event: START-UP Pitching Workshop: 11 September 2019 | City University, CASS Business School Organised by: Talks.dev Hosted by: CASS Entrepreneurs Network Presenter: Ypatios Moysiadis – Cleantech Geek – Coach, Mentor, Angel

Please watch the video and leave your comments below! Don’t forget to subscribe and like!

Can Disruptive Innovation and Start-ups provide the new “Miracles” tackling Climate Change?

Climate Change is a Fact. The world has just begun to understand and feel the magnitude of the damage caused in economic, social and environmental terms.

Unfortunately the time of the Prophets are long gone. No one can really predict the impact that climate change will have in our lives. Nobody can predict how the rise in temperature from greenhouse gases and the changes in weather patterns and precipitation will affect different areas in the world. There are many unknown variables and much to learn about the effect of climate change in agriculture production, economic activities and our health. Furthermore we need to ask ourselves whether the consequences of climate change or the threat of them can cause far worse problems and even violence.

Climate Change, Sustainable Energy, Water Harvesting, Food Security, Urban Farming, Energy Poverty, Energy Storage are buzz phases we hear every day in our lives. Do they actually mean anything, do they have an effect on how we interact with each other and the environment, on how we live our lives? Or they are just an intuitive way for the commercial establishment to push more products or demand more money from our societies?

Well the answer, whether we like it or not is simple. All of the above are effecting millions of people not only on the developing countries but also on modern developed western economies. Everything is interconnected.

As this is a very broad argument it would be useful to focus our attention to two major variables that are both causes and consequences of Climate Change. Energy Poverty and Food Security are major drivers for emissions of greenhouse gases from developing and 3rd world countries. According to Harvard Researchers the emissions trajectory depends greatly on poor countries with the expected fastest annual growth through to 2024.

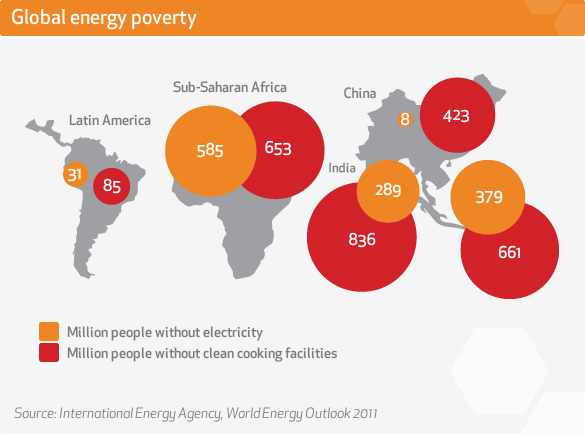

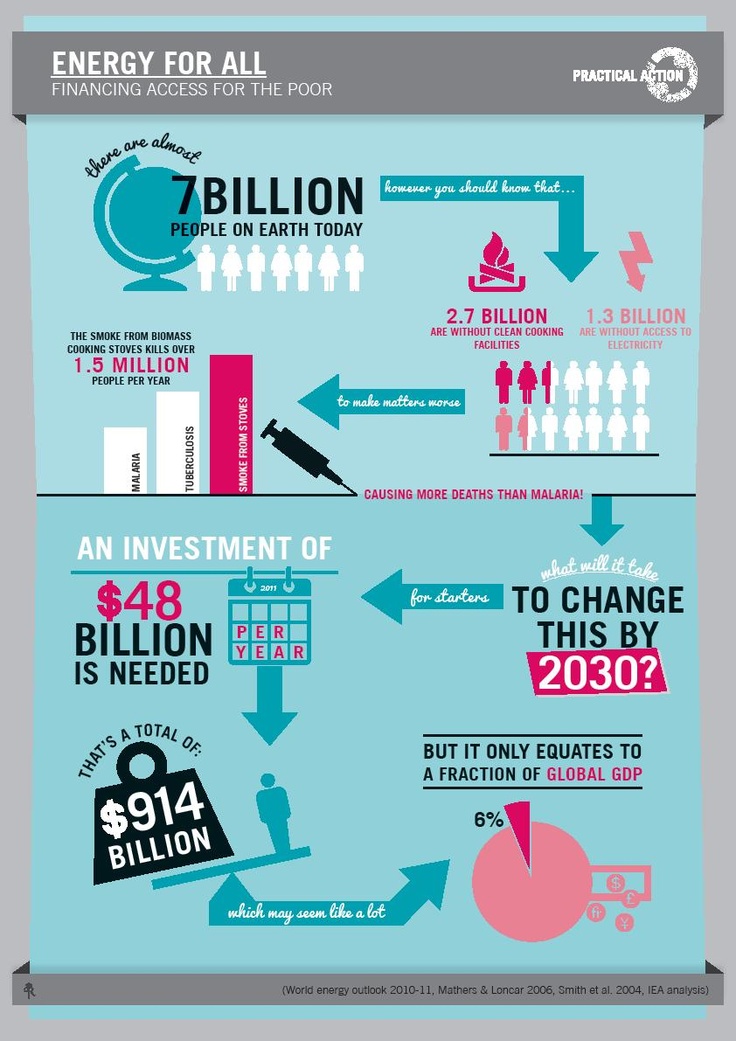

We only need to take a glance at the infographics below to understand the magnitude of the problem.

And if the facts and figures cannot persuade you, maybe the “Terminator” with his strong, politically incorrect quote can…

“I don’t give a f*** if we agree about climate change…First – do you believe it is acceptable that 7 million people die every year from pollution? That’s more than murders, suicides, and car accidents – combined.”

Arnold Schwarzenegger – Actor, Former Governor

Modern energy services are crucial to human well-being and to a country’s economic development; and yet globally over 1.3 billion people are without access to electricity and 2.6 billion people are without clean cooking facilities. More than 95% of these people are either in sub-Saharan African or developing Asia and 84% are in rural areas.

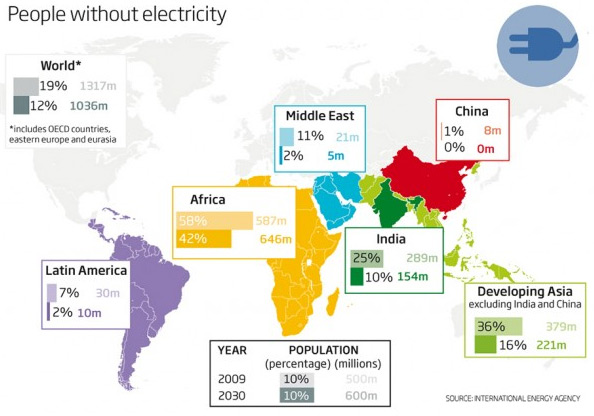

Another map by the International Energy Agency presenting People without electricity as a number and as a percentage. We can identify a positive decreasing pattern by 2030, however we cannot predict whether the additional energy will be provided from fossil fuel or from renewables.

How to achieve global energy access by 2030. $48 billion per year needed or a total of $914 billion.

UN has set a clear roadmap for achieving universal access to energy. To achieve that by 2030, on top of approximately an annual global investment of $50 billion, you need: New Mini / Micro Grids, Decentralised low cost / low maintenance energy generation from renewable sources like solar, small scale lighting solutions with renewable energy and energy storage solutions and finally pioneering government policies and willing leadership.

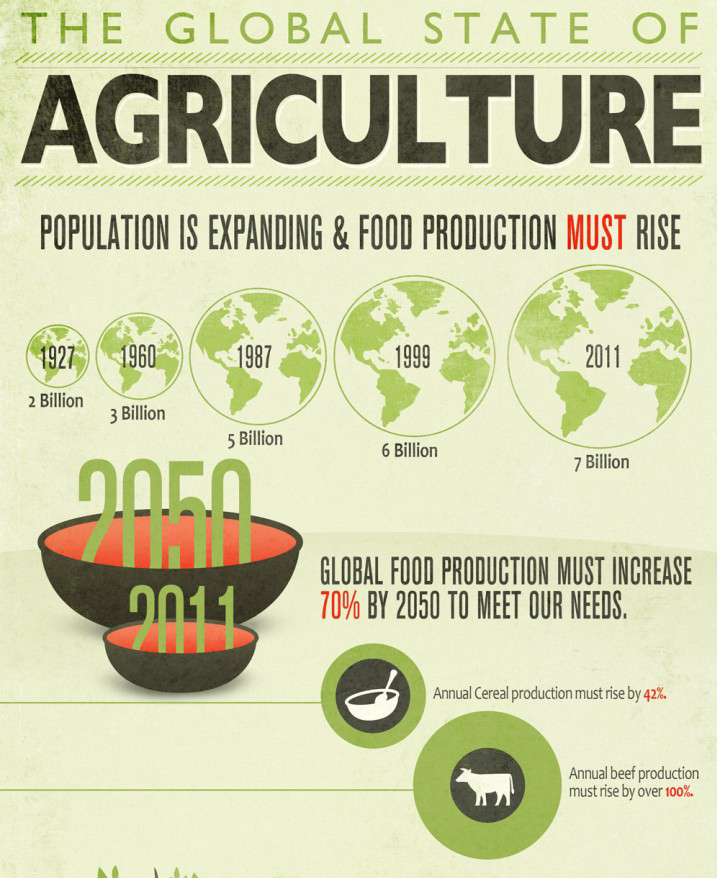

Infographic showing the need for food production increase

http://www.foodmanufacturing.com/news/2014/10/infographic-global-state-agriculture

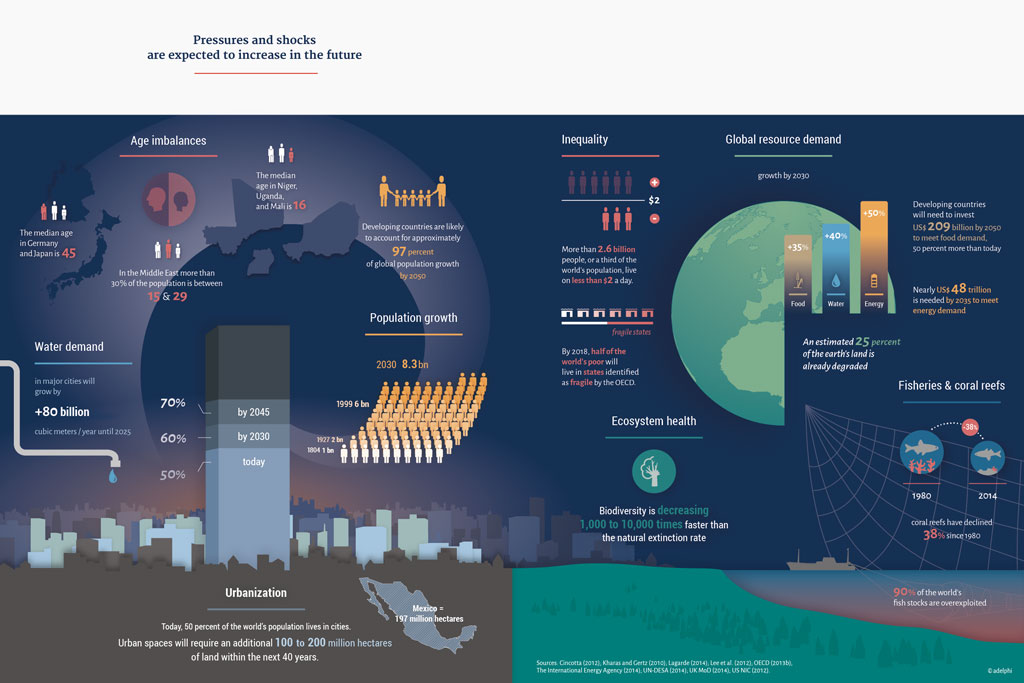

A clear and strong indication of the pressures and shocks that we are likely to face on an increasing rate in the future – https://www.newclimateforpeace.org/G7-report/infographics

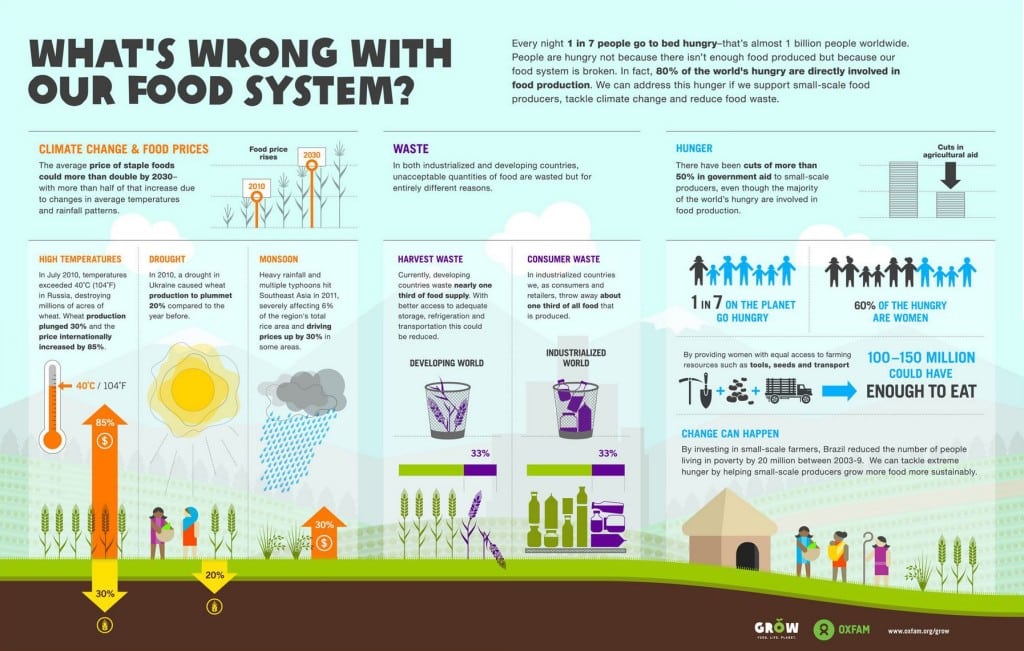

A wonderful infographic by OXFAM demonstrating the impact of climate change, waste and hunger on our food production system http://www.engineeringforchange.org/whats-wrong-with-our-food-system/

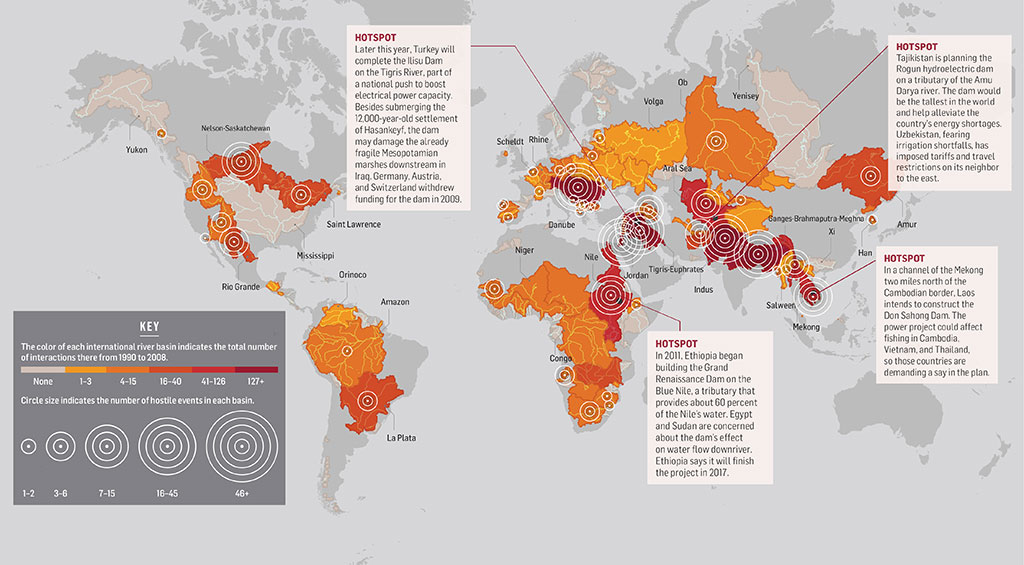

Where will the world’s water conflicts erupt?

The map displays nearly 2,000 incidents, involving conflict and collaboration alike, over shared river basins from 1990 to 2008. The circles in the sidebar compare about 2,200 events—including another 200 disputes over resources other than shared rivers—from the same period.

– http://www.popsci.com/article/science/where-will-worlds-water-conflicts-erupt-infographic

While we let politicians tackle the bigger picture and argue about policies, one question remains. What can we do as individuals or communities through innovation and creative design to improve our carbon footprint and have a positive impact by generating renewable energy and increasing production of carbon neutral food to feed the ever expanding population on our small blue planet?

The Bill Gates CO2 equation and the “energy miracles”: PxSxExC=CO2

Bill Gates in this year’s open letter for Bill & Melinda Gates Foundation, the world’s largest foundation wrote about the our civilisation’s challenge of climate change and the imperative to innovate and develop “energy miracles”. He also came up with a mathematical equation that calculates carbon dioxide emissions as a product of the factors P (population), S (services consumed per person), E (energy used to supply those services) and C (the amount of carbon emitted per unit of energy). According to Gates, the only way to elimination carbon emissions is for C to be zero as P, S and E cannot be at zero and most likely will increase. He argues that for C to be zero we need many “energy miracles”

He concludes by stating that for the “energy miracles” to happen you need, funding, research, innovation and disruptive start-ups.

“… It’s possible there’s some guy in a laboratory today who’s investing something miraculous…”

Bill Gates – Microsoft Cofounder and Philanthropist

The facts above present a massive challenge but also an opportunity. Through design and innovation and by creatively combining current technologies with emerging technologies we can conjure our own small “sustainable miracles” and create practical solutions to tackle most of these problems. The approach should be simple. In the short-term it starts by identifying the problem and then implementing existing of-the-shelf technologies combined with an innovative way, thus providing practical solutions to many problems.

In the long-term develop disruptive new innovative solutions which make commercial sense and provide an added value proposition for the market with a strong social impact potential.

Unfortunately Harry Potter lives only in the fantasy world. So no magic solution for the mess we create and no magic spells to make Climate Change go away. For the rest of us “Muggles” there is only one way to tackle Climate Change and this is through intuitive hard work that pushes boundaries of applied sciences to new limits.

Can Disruptive Innovation and Start-ups provide the new “Miracles” tackling Climate Change? By Ypatios Moysiadis

Entrepreneur’s Insights - Interview with Rafael Badziag, the “Billionaire Magnet” [Video]

Entrepreneur’s Insights - Interview with Rafael Badziag, the “Billionaire Magnet”

This post first appeared on Cleantech Geek: http://cleantechgeek.com/2019/04/entrepreneurs-insights-ep1-interview-with-rafael-badziag-the-billionaire-magnet/

The interview is conducted by our partner, Ypatios Moysiadis on his personal blog. Make sure to check out the blog for interviews, opinions and insights on sustainability and entrepreneurship! Combining articles, video and podcasts he intents to provide the stage for creative thinking and constructive discussions. http://cleantechgeek.com/

Cleantech Geek Entrepreneur’s Insights Series – At this series I will be talking with inspiring Entrepreneurs from our world. We will be discussing about various topics and issues, giving their points of view, sharing their experiences and personal leanings.

At this video I am discussing with Rafael Badziag. Rafael, is a pioneer on e-commerce. He started one of the first successful e-commerce sport related platforms before the .com rise. He then invested in cryptocurrency and domain names amongst other interesting ventures. Despite his success, Rafael did something remarkable. He embarked on a journey to interview and learn from the Billionaires of our generation. Through the process, he tried to unlock the secrets behind their Entrepreneurial Mindset and success. In this interview he talks about some of the learnings and experiences of his journey, gives valuable insights and shares with us the launch if his book: The Billion Dollar Secret: 20 Principles of Billionaire Wealth and Success.

Don’t miss this video with the “Billionaire Magnet”.

Rafael, talks about his background, his successes and failures and how he decided to embark in this almost impossible journey of finding and interviewing 20+ Billionaires of our day. He shares some of the lessons he learned and also discusses about the difference in mindset which is a common denominator across all billionaires.

Watch the video and stay tuned for more! Don't forget to leave your thoughts on the comments below and share it with your network if you found it insightful.