Key Benefits

De-risk investment

Shorten due diligence

Make an impactful investment

Co-invest with likeminded investors

THREE TIER PROBLEM

Early stage investors currently face 3 main problems

Financial loss due to investments in companies that are prone to fail.

Strong probability of failure (9 out of 10 startups fail in a 5-year span)

Unsuccessful deals can unsettle external investors, risking the company’s reputation.

Long term capital commitment in a highly illiquid asset class renders investment in underqualified or unprepared companies a major issue.

Startups require high upfront capital investment to develop their services, technology and market to their full potential.

Significant cost of sourcing investable teams, either dedicated in traveling expenses or committed in advertising.

Exhausting due diligence process, especially when no prior investment or assessment of any kind has been made.

Oftentimes, the selection process is based on intuition, instead of performance metrics and indicators due to lack thereof.

Team dynamics and delegation of leadership are central to the success or failure of a startup, yet it is a challenge to identify such underlying issues during due diligence.

Lack of cultural fit between the startup and investors is another common pitfall which can create a communication gap crucial to the future of not only the relationship, but the company itself.

We are determined to change that!

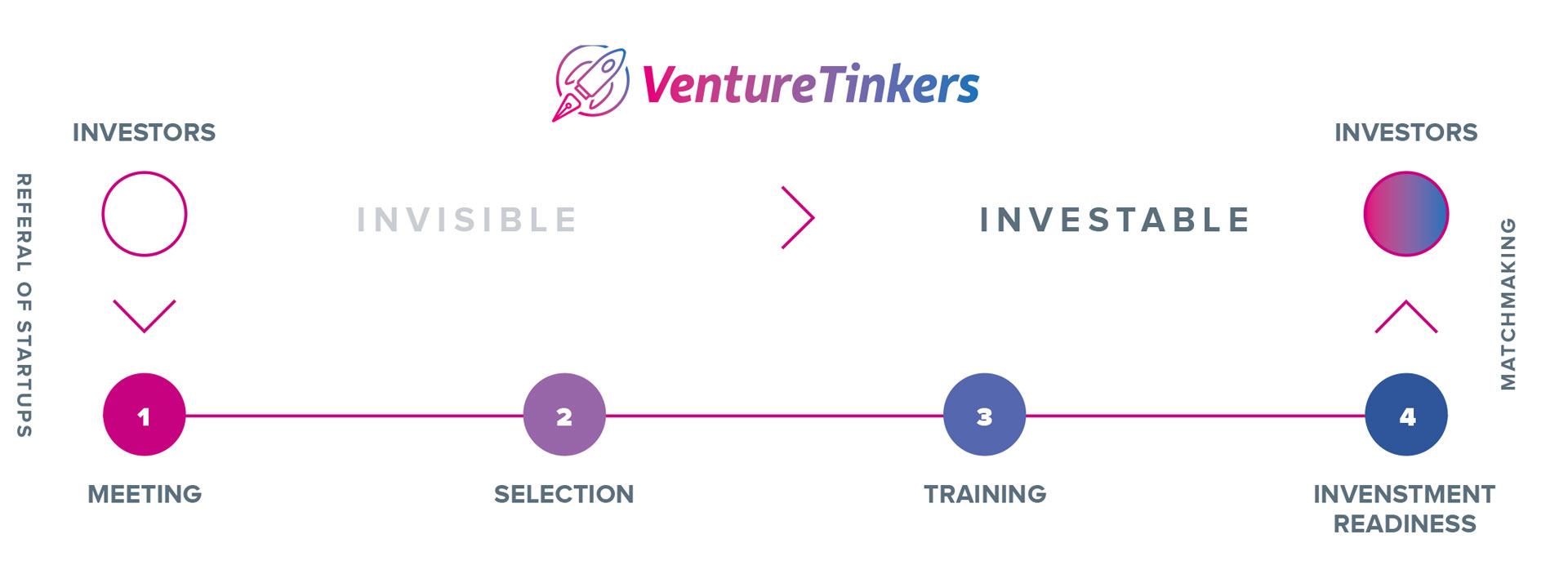

OUR PROCESS

1. MEETING Before each program intake, we hold open discussions with Private Equity, VC funds & individual investors to identify their evaluation criteria and the reasons why startups failed to receive funding after the due diligence process. We then gather notable cases that marginally failed, to help them get to investment readiness and reach funding standards.

2. SELECTION For each mentorship program, we use a rigorous process to handpick the startups that will participate. Thanks to our constant interaction with startups in the past, we have acquired extensive knowledge of the ecosystem and identified the common pitfalls that make even the most interesting companies fail.

3. TRAINING During the intensive sessions, we equip founders with the necessary practical skills, based on market needs and on our belief that the first raise should happen after having generated initial traction.

4. INVENSTMENT READINESS We take responsibility for the startups we introduce to affiliated investors, which are carefully curated, trained and assessed under specific criteria, reducing investor’s risk and positively contributing to the time-consuming due diligence process.

My Global Ventures is not authorised and regulated in the United Kingdom by the Financial Conduct Authority. We are not registered investment adviser and we do not provide investment advice or recommendations.